The 2-Minute Rule for What Is Trade Credit Insurance

Some Known Factual Statements About What Is Trade Credit Insurance

Table of ContentsA Biased View of What Is Trade Credit InsuranceThe Definitive Guide to What Is Trade Credit InsuranceTop Guidelines Of What Is Trade Credit Insurance

After that, throughout the year, if any of those buyers fail or do not pay, after that we will certainly make the repayment. We look at the entire turn over of a business and we finance the whole. "What we're seeing with electronic platforms is that individuals can go online as well as can market a single invoice.

The platforms can see the invoices that are superior and also can make an offer to get those exceptional billings. What the client can after that do is take the choice to guarantee that solitary billing. Once that invoice is insured, it's basically a warranty that the billing will certainly be paid - What is trade credit insurance. "At Euler Hermes, our company believe there's going to be a shift in the method trade debt insurance policy is dispersed.

What Is Trade Credit Insurance Can Be Fun For Everyone

Required a original site broker? See our guide to discovering the right broker.

A supplier with a margin of 4% that experiences a non-payment of 50,000 would require 25 equivalent sales to make up for a solitary instance of non-payment. Credit insurance policy reduces versus this loss. You can reduce investing on credit report details as that's covered, as well as you won't need to waste resources on chasing collections.

You may have the ability to bargain beneficial terms with your vendors as a credit insurance plan lowers the impact of an uncollectable bill on them and potentially the whole supply chain. Debt insurance policy is there to aid you prevent and also reduce your trading threats, so you can develop your company with the understanding that your accounts are shielded.

A business wished to expand sales with its existing weblink customers yet was not completely comfy using them greater credit line. They contacted check that Coface credit score insurance to cover the greater credit line so they could enhance the quantity of credit score used to consumers without danger - What is trade credit insurance. This let them expand earnings and also provide more earnings.

How What Is Trade Credit Insurance can Save You Time, Stress, and Money.

"From the initial goal of offering convenience to our banks, the service included depth to our business choices." The interaction allowed the firm to evaluate its clients' condition extra accurately as well as has actually been a beneficial device in organization development.

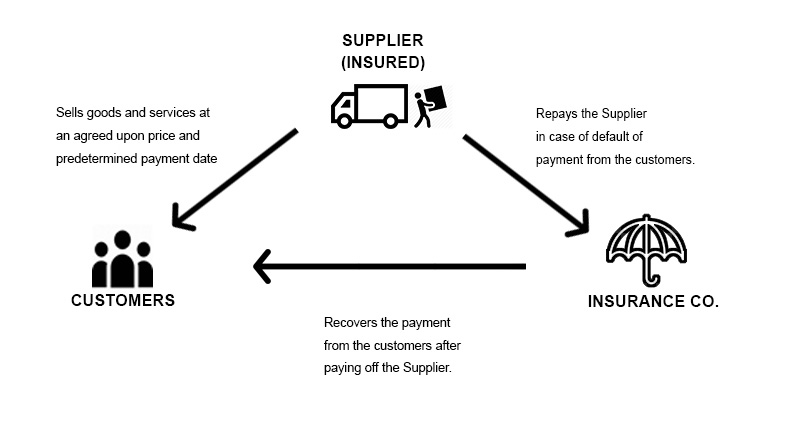

Taking out profession credit scores insurance coverage is one way you can do this. Trade debt insurance coverage gives cover when a client either comes to be financially troubled or does not pay its financial debts after a specific period (which is established out in the insurance coverage policy).

"In case a financial obligation is unpaid, the plan holder might be able to claim approximately 90 per cent of the quantity of that financial obligation, taking into consideration any kind of excesses that might matter," he includes. When it pertains to collecting the financial debt, frequently the insurer will certainly have its own financial obligation debt collection agency and also will go after the financial obligation on part of the company.